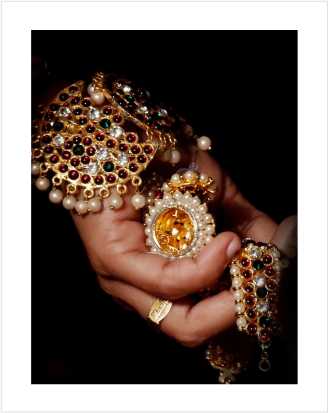

Gold loan distributor Ruptok acquires Mumbai-based Golduno to expand reach

Read More

- Tokenise your Jewellery

- Keep all the Jewellery Documents at one Place

- Get Jewellery Valuation Certificate

- Get Nav Tracking

- Location tracking throughout the process

- Insurance of your jewellery

- Accurate weight and contents

- Borrow the jewellery

- Get Doorstep logistics

- One tap asset trasfer to you

- BNPL purchase option

- Authencity assurance

- Get doorstep logistics